Bill Rossi

Over the past 15 years, dentists have been signing up for more and more PPO’s. Write off’s have increased dramatically! For example, in the upper midwest, the average collection percentage is about 83% of gross. That’s nearly two months a year doctors are working for free because of PPO write offs!

In other parts of the country it’s better, and in some areas, it’s much worse. It’s not unusual for me to field calls from dentists who are collecting as low as 70%, 65%, and even 55% of their production.

Doctors, you’ve learned how to sign-up for PPO’s. Now, it’s time to learn how to cut back on PPO participation, and push up your collections. Take a look at your collection percentage. If it’s under 85%, it’s likely that you can do something about it. What if you added 3, 5, 10 or even 15 points more to your collection percentage?

You have more power than you think! Although few practices can be completely “non-participating” with all insurances, it is possible to balance your PPO participation. In a way, balancing PPO participation is now, in effect, balancing your fees. Remember when you used to be able to set your own fees?

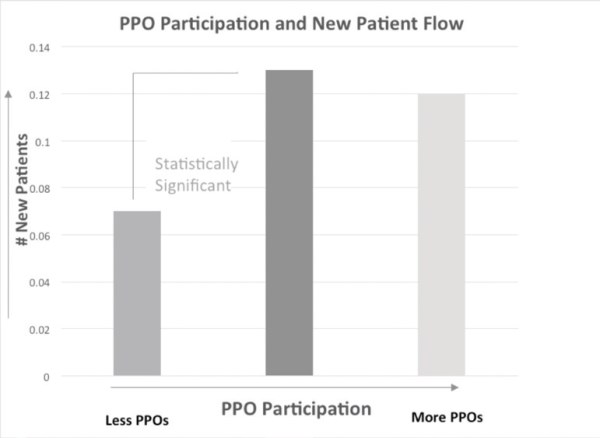

We have found that dental practices not in network with any insurance companies do generally attract fewer new patients. Yet, practices that add many PPO’s don’t get increases in new patients in proportion to their PPO participation. There is a point of diminishing returns when you take on PPO’s (see graph on the next page).

Doctors often sign-up with plans hoping they’ll be on the insurance company list and get more new patients. However, in many cases you just turn patients you already have into deep discount PPO patients. Even if you’re on the insurance company lists, you may be buried below the corporate mega-practices. Plus, although it’s true that insurance participation is important to patients, it is not the major factor in how many new patients you’ll attract.

Yes, I see practices with lots of PPO’s that get lots of new patients, but I also see practices with balanced PPO participation that do too.

When it comes to new patient numbers there’s much more correlation with visibility, location, signage, web presence and business hours than there is PPO participation.

Doctors, chances are you’re already seeing some patients out of network. In many cases, the out-of-network benefits with insurance is surprisingly good. However, if you’re participating in a plan, you don’t “see the other side of the curtain,” and may not be aware that’s the case.

Most patients receive dental insurance through their employers. Why do employers offer insurance to their employees? To make them happy! Of course, the employer wants to get the insurance at the lowest possible cost. But, if the employees can’t go to the doctor of their choice they aren’t happy. Insurance companies know this and that’s why it’s important to them to have a large network of providers and not to have punitive out of network benefits. They want patients to be happy too, although they clearly also want to give them incentives to go to the in-network office.

So how and when do you go about dropping a PPO?

Contrary to what you might have heard, you don’t necessarily start with the PPO’s with the lowest fee schedules. There are other factors involved such as; the size of the PPO in your practice (smaller is better if you’re learning how to go through the drop/transition process), the out-of-network benefit sets, and whether or not the company is a pain for your administrative staff in processing claims.

For starters, I advise doctors to peel off a PPO that is about 10%-15% of their practice. Typically, doctors are taking their 30%, or 40% discount on that PPO. So, if they can peel it off and otherwise keep most of the patients (and they will if they do things right). They can add 5 or more points to their collection percentage.

When going through those transitions there are two objectives:

1. To minimize any loss of patients.

2. To slow down any loss of patient.

When evaluating these situations, I ask the doctor to assume if they lost half of the patients in a given PPO, would their practice have enough underlying vitality to “heal” over that loss. Actually, if you do things well, you will not lose half, but for arguments sake, make that assumption.

If a PPO is 15% of your practice, and you lose half of it, that’s 7%. If you lose 7% of your patients next month, that can certainly hurt. However, if the loss of 7% of your patients is over two years you have plenty of time to “heal” or counteract those losses. Meanwhile, you’re collecting more and gaining more control over your own practice.

So how do you minimize patient loss? By training your staff so they know how to tactfully deal with patients in, and out of network. The key is not to make too big a deal about it. Again doctor, you’re already seeing patients out of network. If you accentuate the positive, and the patients otherwise like your office, you’ll be fine.

“You’re lucky to have insurance. We’ll do our best to get the most out of your coverage here!”

“The good thing about your insurance is, you can go to the doctor of your choice.”

“We work with many insurances both in, and out of network. Patients with XYZ insurance have had good benefits here…”

How do you slow down the loss of patients? For one thing, avoid writing letters! For some reason, doctors reflexively feel they must send letters when they drop a PPO. This can cause a lot of confusion and damage to your practice. Not only will mass mailings cause a greater loss of patients, it will also speed up any loss you have. Also, it could be dangerous to send letters because if you say something the insurance company doesn’t like, they may go after you.

We feel it’s best to talk to patients face-to-face. We feel that is best because you can see the patient’s body language and hone your message. Or, you can send out small batches of letters and follow up with calls. Or, you can go with a phone campaign. You work to call patients in for recall appointments, it’s definitely worth it to organize a phone campaign to talk to patients regarding the transition.

As a rule of thumb, I don’t recommend sending letters to insurance patients unless the insurance company is sending letters. Most of the time they don’t because again, they don’t want to stir up bad feelings either.

What can you expect? We’ve helped many doctors through this process, and most are surprised at how smoothly it goes. Yes, there always is some loss of patients. If patients have zero out-of-network benefits, you will lose them. If they’re young and cash strapped with multiple family members, you’re more likely to lose them. Yet, I see practices that have never been in network with insurance companies like MetLife, Delta PPO, Aetna, Health Partners, etc., have plenty of patients on those plans. The same goes for offices that transition out of network with those plans.

There is probably nothing else that you can do to add more to your bottom line, not just this year but for years to come. Learn how to balance your insurance participation. The alternative is to sign-up with every plan, in which case, you’ll have to work faster and faster to outrun the discounts. Also, there is the matter of equitability. What about the patients that don’t have insurance? They’re paying your full fee, and in effect subsidizing the insurance companies and their subsidiaries. Where is the fairness in that? Not just to you, but to the other patients? If dentists keep signing up for the cheaper and cheaper plans out of fear of loosing patients, it’s a race to the bottom.

Remember, you have more power than you think you do. Make it your goal to peel back on a PPO or two in the coming year. You’ll be glad you did.

Bill Rossi and his team have over 35 years in practice management. You may contact Mr. Rossi atbrossi.apm@gmail.com.