Bill Rossi

In previous article “Doctors, It’s Time to Push Back on PPOs” (The Profitable Dentist – May 2018), I wrote about how dentists have been getting deeper and deeper into PPO participation over the last 15 years and how it’s starting to have severe consequences on collections, the bottom line and even practice sovereignty. I also explained how doctors have more power then they think they do in dealing with this challenge.

In this article I am going to suggest the steps you can take to start closing the gap between production and collections. They are:

1. Assess

2. Negotiate

3. ACT!

Start by gathering information.

1. How much do you write off per year for the PPO plans with the biggest presence in your practice?

Many offices just have one “Insurance adjustment” code. For the most active PPOs in your office (e.g.

Delta, MetLife, etc.), you will want to set up a code for each company. This way you can get a closer idea of what participation with any particular PPO costs.

2. An estimate of the number or percentage of your patients on those plans.

3. A comparative analysis of the plan’s fees versus yours.

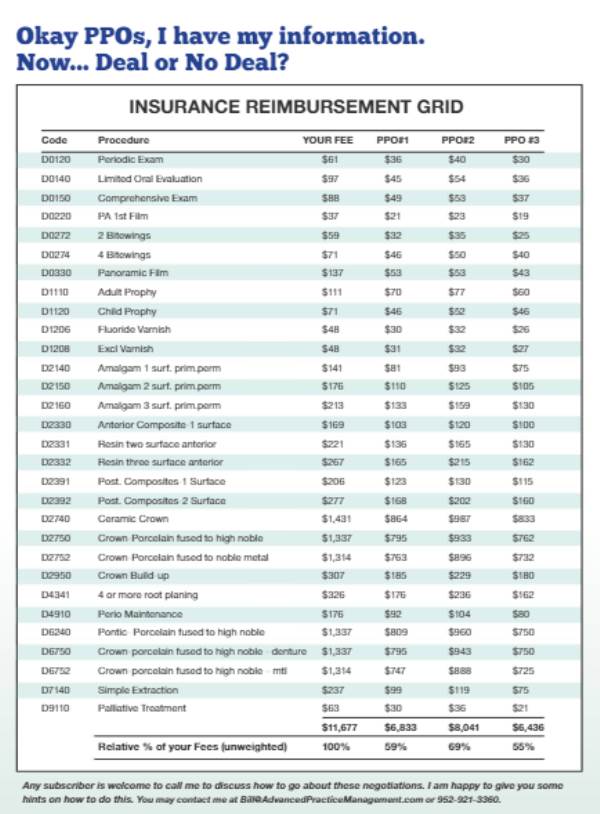

Make your own “Insurance Reimbursement Grid” (see example on p.43). List your fees and a sampling of the fees for the various PPOs in your practice. You will find this very useful. Naturally you will want to look at the procedures that have the biggest revenue impact (which is a function of frequency and fees and includes procedures for the typical general dental practice like adult prophies, crowns, periodic exams and so on – you can get this from your Analysis of Charges (every Practice Management software has a version of this).

PLAY PPO POKER!

After you list the fees, you can total the columns and get an unweighted estimate of the approximate discount on the various plans. As importantly, you can see which plans paid better on which items. You can use this in your negotiations.

Part of the value of this grid is to put fire in your belly because when you look at what the various plans are paying you, it’s likely to stir you up a bit. That is good because one of the reasons that doctors persist with too much PPO participation for too long is that they are not really aware of how much they are writing off (you don’t have to write a check for what you have to write off) and how low the fees really are.

Now that you have the information in hand, it is time to play PPO Poker!

Identify and call the Provider Relations person at the PPO. That is, the “Network Manager.” In every PPO there is someone who is recognized or compensated for developing and maintaining their network of participating doctors. They, not the lower level bureaucrats, have an interest in maintaining your participation. After you find out the name of the person and have an initial conversation, get their email address. After that you can correspond by email if you prefer.

You’ll notice that different insurance companies pay differently although they all claim to pay some version of the UCR. And you may be shocked to know that they often pay different providers in the same area differently. We see it all the time. So, call them and say,

“I just want to make sure I’m treated fairly. Is this the best you can do? How come other insurance companies can pay me more for a 2740 crown and a 3-surface composite than you are?”

If they agree to review your fees, ask them for a specific timeline. Make sure you have noted who you talked to and when.

I feel it is best that the doctor personally does this but if you really don’t want to do it, it is better to have your office manager do it than not have it get done at all! He/she should still invoke the power of the doctor though.

“I know the doctor is unhappy with the current fee schedule and he/she is considering dropping. So, I’ve been asked to see if you can do any better….”

SHOULD YOU HIRE SOMEONE TO NEGOTIATE FOR YOU?

If you are deep into PPO participation and are in networks such as Dentemax, Connection; and/or you are contracted with lots of PPOs it can be very helpful to use a firm that specializes in Dental PPO negotiations. They are very good at organizing the data and helping untangle the networks. Two organizations that come to mind are:

Unlock the PPO: Sandi Hudson

Veritas: Ben Tuinei

Help@VeritasDentalResources.com Phone 888-808-4513

It is possible that you can get greater reimbursement by directly participating with the PPOs or in some cases by indirectly going through a PPO Network like Dentemax. It varies case by case.

For the foreseeable future, every doctor and practice is going to have to deal with the PPOs. I feel it’s best if you learn how to negotiate yourself, but the above companies can certainly help get you started.

OK, it’s fine to negotiate but the REAL GAINS come from transitioning out of (at least some) PPOs.

Let’s say that your analysis shows that you are writing off about $8,000 per month for XYZ PPO. If you leave that PPO and keep the balance of the patients, your bottom line can come up very nicely. Simply put, if you are discounting 40% of your fees, you can lose up to 40% of those PPO patients and still be ahead revenue wise. However, if the conditions are right and you go through the transition wisely you will retain most of those patients. As I say, “Lose the discounts, keep the patients.”

Some PPOs won’t deal unless you drop the hammer! Those that did not negotiate may negotiate when they get a drop notice. I don’t suggest you send a drop notice unless you’ll be OK with going through with it, but if they counter and come up a lot in their fees, celebrate and move on to the next PPO.

So doctors, once in awhile pick up the phone instead of a hand piece and you can add thousands to your bottom line.

“Next Issue: Transitioning from a PPO to a stronger, more profitable practice.”

Bill Rossi has over 35 years in practice management. He is an ally for private and independent practices in a profession increasingly impinged on by corporate dentistry and PPOs. You may contact Bill atBill@AdvancedPracticeManagement.com, 952-921-3360, or his website atAdvancedPracticeManagement.com.