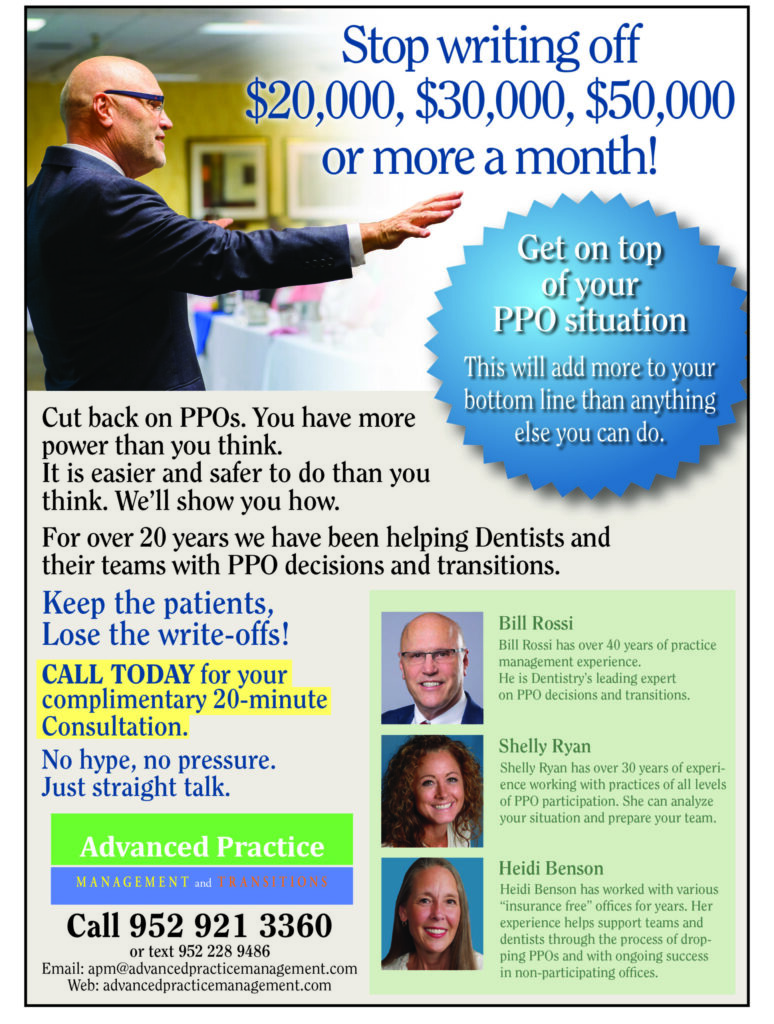

Bill Rossi is the country’s leading expert on PPO decisions and transitions. PPO decisions must be made in the context of the practice’s realities. Bill has over 35 years’ experience in advising dental practices. For the past 20 years he has helped many dentists strategically and safely cut back on their PPO participation. This has added substantially to their bottom lines and their practice independence.

Call 952-921-3360 or text 952-228-9486 for your 30-minute consultation. No pressure, no bull; just a chance to find out more. Or schedule your 30-minute consult with Bill by clicking here.

Robyn Theisen Is the country’s leading coach in helping doctors and their teams drop Delta and other PPOs. Doctors from Philadelphia to Albuquerque have enjoyed her down to earth, positive approach and deep management experience.

Call 952-921-3360 or text 952-228-9486 for your 30-minute consultation. No pressure, no bull; just a chance to find out more.

30 years of dental experience in clinical, front desk, office management, training and consulting.

Shelly often works as a player coach, side-by-side with administrative and clinical staff as an experienced colleague. Staffs respond well when Shelly works with them on verbal skills, communication, conflict resolution and accountability.